Pound dives after Brexit resignations

The pound has fallen sharply after Cabinet ministers Dominic Raab and Esther McVey quit over Prime Minister Theresa May's draft Brexit deal.

Sterling fell more than 1% against the dollar to $1.2778 and also sank more than 1% against the euro to €1.1309.

On Wednesday, Theresa May had secured Cabinet backing for the draft Brexit agreement with Brussels.

Business had generally welcomed the agreement, as it avoided the prospect of a cliff-edge Brexit.

What has happened to the pound?

What has happened to the pound?

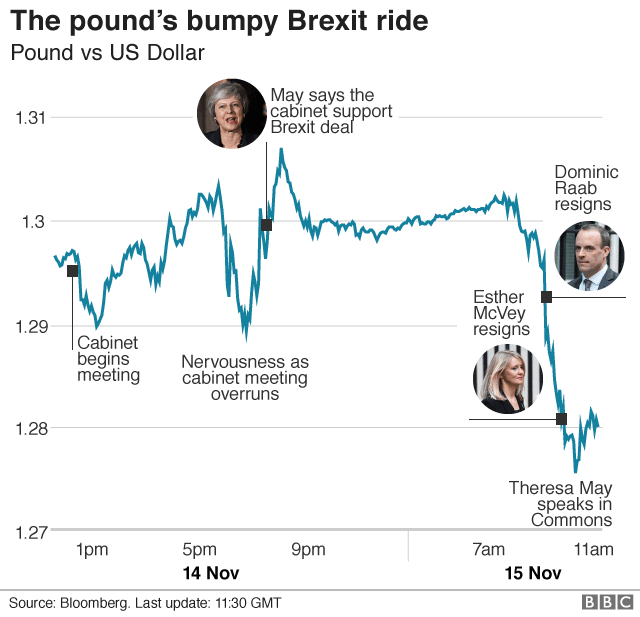

Initially the pound had rallied on Wednesday after the Prime Minister announced she had the backing of the cabinet for her Brexit withdrawal plan.

Wednesday's trading had been volatile, while the outcome of Theresa May's five-hour meeting with cabinet colleagues remained unclear.

Sterling had fallen to $1.28 at one point, but then rose to $1.30 following the announcement, before falling back slightly.

However, on Thursday morning sterling fell after Junior Northern Ireland Minister Shailesh Vara quit in protest over the agreement, and then dropped sharply when Brexit Secretary Dominic Raab resigned.

Shortly afterwards, Work and Pensions Secretary Esther McVey also stepped down. Junior Brexit Minister Suella Braverman, and Parliamentary Private Secretary Anne-Marie Trevelyan were next to go, followed by Ranil Jayawardena, another Parliamentary Private Secretary.

Pound vs US dollar

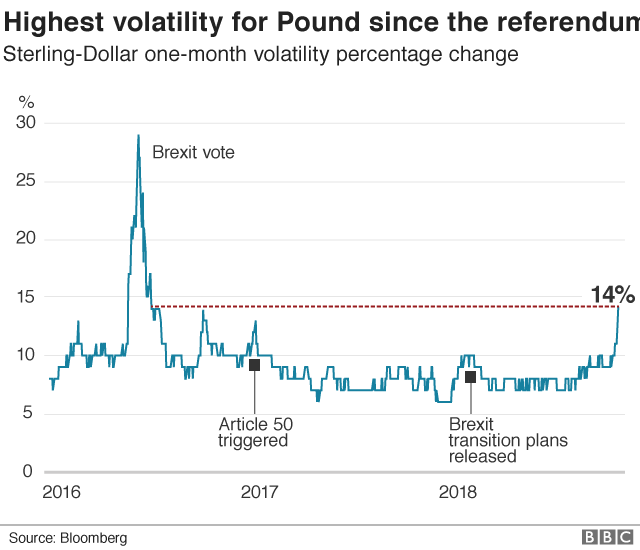

How has Brexit affected the pound's volatility?

The Brexit process has been punctuated by big movements in the pound's relationship with the dollar, something which can lead to big gains or losses for investors.

In the run up to and immediate aftermath of the Brexit referendum on 23 June 2016, for example, the pound hit a peak of volatility against the dollar amid enormous uncertainty about the future.

And as the graphic below shows, the events surrounding Wednesday's draft agreement has triggered the greatest volatility for sterling since the referendum.

What do the currency strategists make of it?

Jane Foley, head of currency strategy at Rabobank, said the pound's plunge was "firmly tied" to the perception that Mrs May will have difficulty in pushing the Brexit plan through Parliament.

In addition, Ms Foley said the government resignations had emphasised speculation that Mrs May could face a no-confidence vote.

"Although [Mrs] May has appeared defiant in Parliament this morning, the next few days will clearly be crucial with respect to whether [she] is likely to gain Parliamentary approval for her Brexit deal, but also in determining whether she can hold on to office.

"A lack of Parliamentary approval for the deal or a hard Brexit would both weigh heavily on the pound. Any turn of events that could raise the risk of a general election would also punish the pound, given the risk of a market-unfriendly far-left government."

Chris Turner, head of foreign exchange at ING, said Mr Raab's resignation had increased the chances of a leadership challenge and a no-deal Brexit.

Even though it was "very hard" to make forecasts about the pound's direction, he said it "could fall another 3-4% unless the threat of a leadership election is quashed or there are clearer signs that the withdrawal agreement can garner more support in parliament".

How did the government sell the agreement to business?

Sir Roger Carr is chairman of BAE Systems. He also chairs one of the prime minister's five new business councils set up to advise on how to create the best business conditions in the UK after Brexit.

He was on the conference call that Chancellor Philip Hammond and Business Secretary Greg Clark held with bosses on Wednesday night following the agreement.

He said Mr Hammond and Mr Clark were trying to be clear "that this had been a long and hard process in persistence and resilience, but it had reached a conclusion which would be much much better than the chaos of no decision".

"It had the key elements in it that people were looking for particularly in the sense of a pathway to frictionless trade and control over our borders, the preservation of the United Kingdom, and in those circumstances they were recommending that business leaders support it, and I have to say the response on the call was a positive one."

So what does big business make of the agreement?

The agreement includes a 21-month transition period, with a unilateral right for the UK to extend it, which was described as "very positive for business" by James Stewart, head of Brexit at KPMG UK.

Northern Ireland also has the guarantee of a "friction-free" customs border with the Republic of Ireland.

The CBI described the agreement as a "compromise, including for business" but it unreservedly welcomed the "step back from the cliff-edge".

Director general Carolyn Fairbairn told the BBC: "The second plus of where we got to yesterday is there is a possible path to frictionless trade now in terms of negotiating the final deal.

"I don't think anyone thinks the transition or the backstop is the answer, so this has to be used as a route to a final deal with frictionless trade and access for services."

However, she did sound a note of caution. "It's not the end of the road - there's a hard slog ahead to get that final deal that will work for the country,"

So is everyone happy?

Dr Gerard Lyons, chief economic strategist at Netwealth Investment and chief economic adviser to Boris Johnson while he was Mayor of London, says the draft Brexit withdrawal deal is not something to cheer about.

"Whilst it has avoided the cliff edge, I think it's important we don't bury our heads in the sands here and view this as a 'good' deal - this is still disappointing," he said.

"To make a success of Brexit, we've got to get three things right - our relationship with the EU, our position with the rest of the world and our domestic economic and financial agenda.

"The biggest single problem with this divorce settlement is it ties our hands on two of those three areas - our ability to position ourselves globally and our domestic economic agenda."

No comments